Which Is Best for Your Business – Proprietorship, Partnership, Corporation, or Limited Liability Company?

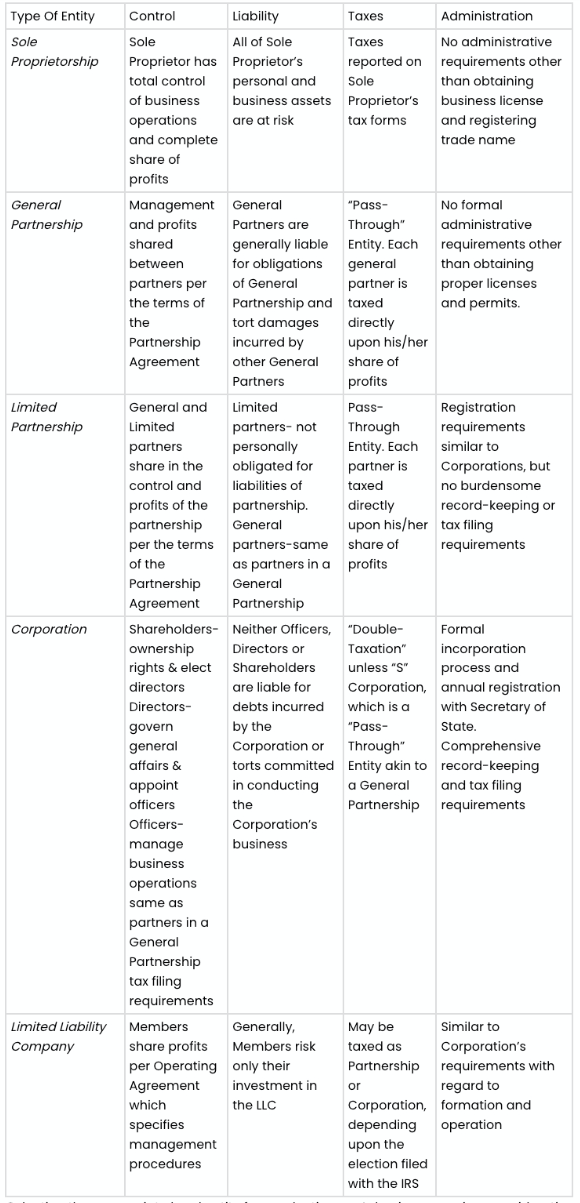

Selecting the appropriate legal entity for conducting one’s business requires consideration of many factors. This chart sets forth some of the basic characteristics of five different types of legal entities. It is unlikely that you will be able to select the entity most appropriate for your business by only reading this chart. Consult private counsel to select the legal entity most appropriate for your business.

Selecting the appropriate legal entity for conducting one’s business requires consideration of many factors. This chart sets forth some of the basic characteristics of five different types of legal entities. It is unlikely that you will be able to select the entity most appropriate for your business by only reading this chart. Consult private counsel to select the legal entity most appropriate for your business.

Following is more information on each of the five entities outlined briefly in the above chart.

Corporations

A corporation is a legal entity that is separate from its owners, the shareholders. It is formed by filing certain documents with the Secretary of State and taking other actions required by the Code. A corporation may have perpetual existence, meaning that it continues to exist regardless of the status of the individual shareholders.

CONTROL A corporation is composed of three different “players”: the shareholders, directors and officers. It is critical to understand that these players have different responsibilities, obligations and authorities. The shareholders own the corporation and elect the directors. The directors govern the general affairs of the corporation and appoint officers who conduct the day to day business of the corporation. It is typical in smaller corporations for an individual to hold two or three “player” positions. In fact, one person can be the sole shareholder, director and officer.

LIABILITY Limited liability is the most important reason to incorporate. The debts incurred by the corporation cannot generally be collected from the officers, directors or shareholders of the corporation. This allows one to protect his or her personal assets from the debts and obligations of the corporation. However, oftentimes shareholders are called upon to guaranty payment of the debts of the corporation. It is important to keep personal and business dealings separate from the corporation’s business in order to ensure that one cannot be personally liable for obligations of the corporation.

May be taxed as Partnership or Corporation, depending upon the election filed with the IRS

Similar to Corporation’s requirements with regard to formation and operation

TAXATION “For profit” corporations (other than S corporations, which are discussed below) are subject to what is know as “double taxation.” This means that the corporation pays tax on the income earned by the corporation and its shareholders pay tax on dividends received from the corporation. An S corporation is not subject to double taxation. Rather, for tax purposes, it is known as a “pass- through” entity (as is a partnership). The term “pass-through” means that there is no tax on the corporation, but that the income and losses of the S corporation are passed through to the shareholders in proportion to their ownership interests whether or not they record a distribution. A corporation can be an S corporation merely by meeting certain eligibility requirements and making a special election with the IRS. These eligibility requirements include having no more than 75 shareholders who must be individuals or certain trusts or estates. Further, the shareholders may not be non-resident aliens and the S corporation can only have one class of stock. From a legal standpoint, an S corporation is no different than any other corporation. It is organized and operated like other corporations and has all of the characteristics of a corporation described above. From a tax perspective, however, they are very different. A tax professional should be consulted to determine whether the shareholders will benefit from causing a corporation to make an S election.

ADMINISTRATION The corporate form of doing business does have some disadvantages. Sine the corporation is a separate entity, it must file tax returns and pay taxes on its income. A corporation must maintain certain records in order to ensure that its corporate status is maintained. This means additional accounting and legal costs associated with using the corporate form of doing business.

Limited Liability Companies (LLC’s)

The Limited Liability Company (LLC) is a business entity organized under state law that offers limited liability like a corporation along with the possibility of “passthrough” taxation, unless it elects corporate treatment for federal tax purposes. Therefore, an LLC is a cross between a partnership and a corporation. An LLC is owned by one or more interest holders called “members” and any member can exercise management rights. However, an LLC also allows the members to manage the entity or to designate specific managers who may or may not be members, to manage the entity as is done in many corporations. Like a corporation, an LLC has the advantage of “perpetual” existence — its business operations can continue despite the death of someone who owns a business interest. Ownership interests are transferred easily from one member to another.

LIABILITY As its name implies, the LLC provides limited liability for its owners similar to shareholders in a corporation. The LLC owner risks only their investment in the business. Other personal assets are not a risk, unless the owner has personally guaranteed the debt.

TAXATION Under new IRS regulations, the LLC with more than one member will be taxed as a partnership unless it elects to be taxed as a corporation and the LLC with only one member will be disregarded for tax purposes. If it is treated as a partnership, the LLC’s earnings will be apportioned to its owners and taxed at their personal tax rates, similar to the tax treatment of a limited partnership. However, it is possible to elect corporate tax treatment, whereby it will be taxed as a corporation.

ADMINISTRATION The process of creating an LLC closely resembles the process of creating a corporation. Georgia law requires that “Articles of Organization” be filed with the Secretary of State. An LLC has an “operating agreement” which, like the agreement of partnership or LP, determines the conduct of the business, including the rights and powers of its members, managers, and employees and which generally allows the members to structure the company’s affairs as they see fit, rather than as a statute requires.

Sole Proprietorship

The sole proprietorship is the simplest, least regulated and most common form of business organization. Legally and for tax purposes the individual owner is the business. The liabilities and profits are personal to the owner.

CONTROL The sole proprietor has total control of the business. The problem with total control is that if the owner dies, the business ceases to exist. The assets and liabilities of the sole proprietor will pass to his or her estate, but often the expertise and knowledge of the business usually die with the sole proprietor. A competent estate planning lawyer can assist the sole proprietor in arranging for the business to be transferred to a family member or some other person upon the death of the sole proprietor.

LIABILITY In a sole proprietorship, all of the personal and business assets of the sole proprietor are at risk. One obtaining a legal judgment for damages against a sole proprietor can secure a lien against his or her personal assets and can foreclose on the lien. This unlimited liability is the greatest disadvantage of this type of business form. Different types of insurance coverage are available to lessen the perils of having one’s personal assets at risk.

TAXATION Taxes are reported on the sole proprietor’s personal income tax forms. The sole proprietorship is the simplest form of business for tax purposes. As the business grows, the sole proprietor may wish to change to another business organization if it would result in significantly lower taxes. Sole proprietors should also contact their local, state and federal tax authorities regarding the collection of sales and other taxes.

ADMINISTRATION The sole proprietor should maintain adequate records to successfully run the business and for tax purposes. However, there are no administrative requirements, such as maintaining minutes of meetings or passing resolutions, with which he or she must comply. Usually, the only requirement is to obtain and pay the fee for a local business license. Georgia also requires that a sole proprietor operating under a trade name register in the county where it will transact a majority of its business. This allows creditors and others the opportunity to learn the identity of the actual owner, since it will be the owner who is personally liable for the debts and obligations of the business.

General Partnership

The legal form of doing business as a general partnership comes into existence when there is an association of two or more persons, the general partners, who carry on a business for profit as co- owners. The existence of a profit motive is essential. No filing or other registration with the Secretary of State is required.

CONTROL Each general partner has a right to participate in partnership management, as well as a right to share in the profits of the partnership. The issue of control can be addressed with a partnership agreement. This written agreement is not legally required, but it encourages specificity. An interest in a general partnership cannot be transferred without the consent of the other general partners (unless the transferred interest is only a right to profits). Death or withdrawal of any general partner dissolves the general partnership.

LIABILITY Each general partner has joint and several unlimited personal liability for obligations of the general partnership. This means that each general partner has the potential of being personally indebted for each obligation of the general partnership. One general partner’s actions can make another general partner personally liable on a contract. Similarly, the actions or torts of one general partner arising in the ordinary course of the general partnership’s business can result in another general partner being personally liable on a contract or in a lawsuit. Further, a general partner owes the utmost duty to the general partnership and to each of the other general partners. In order to limit the liability of a general partner, such entities often elect to be treated as a LLP by filing a certificate with the Secretary of State.

TAXATION Partnerships are “pass-through” entities for tax purposes; the general partnership itself does not pay taxes. Each general partner takes into account his or her share of general partnership income, losses, deductions and credits in determining his or her personal tax liability. A partnership agreement may provide for the allocation of these tax benefits and burdens.

ADMINISTRATION General partnerships do not require any formal organizational meeting or state filing requirement to come into existence. The only obligations required are those germane to all business entities such as a business license, trade name registration, proper permits and the like, unless a decision is made to elect LLP status.

Limited Partnerships (LP’s)

A limited partnership is composed of general partners and limited partners. The defining characteristic of a limited partnership is that limited partners can invest capital in a business of the limited partnership and take a share in the profits without becoming personally liable for partnership debts and obligations.

CONTROL Unlike limited partnerships in many other states, in Georgia limited partners may participate in controlling the business without becoming personally liable for the limited partnership’s obligations. Thus, Georgia is a particularly attractive state for the formation of limited partnerships in which limited partners wish to have an active role in the management and control of limited partnership affairs. The limited partnership agreement may govern which partners or classes of partners control the entity. As with general partnerships, Georgia law will govern the handling of matters not addressed in the partnership agreement. General partners have equal rights to participate in the management of the limited partnership and have the power to bind the limited partnership in transactions with third parties. A limited partner can assign his or her interest in the profits of the limited partnership and the assignee may become a limited partner if the limited partnership agreement so provides or if all other partners consent.

LIABILITY As mentioned above, limited partners are not personally obligated for the liabilities of the limited partnership by reason of being a limited partner and do not become so by participating in the management or control of the business. A general partner has unlimited liability, similar to a general partner in a general partnership (except as otherwise provided in the Georgia Revised Uniform Limited Partnership Act). To avoid such unlimited liability, many limited partnerships have a corporation as their general partner. Alternatively, the entity may limit the liability of the general partner by electing LLP status through a filing with the Secretary of State. Each general partner owes the utmost duty to the limited partnership and to each of the other general and limited partners.

TAXATION The limited partnership pays no entity-level income tax or net worth tax, and each partner is taxed directly upon his or her respective distributive share of the limited partnership’s profits (which may or may not be the same as their ownership percentage), unless the limited partnership elects to be taxable as a corporation.

ADMINISTRATION Limited partnerships in Georgia are required to register with the Secretary of State, but are governed by a Limited Partnership Agreement among the parties, and generally do not have to contend with burdensome requirements for filings, publications, or record maintenance.