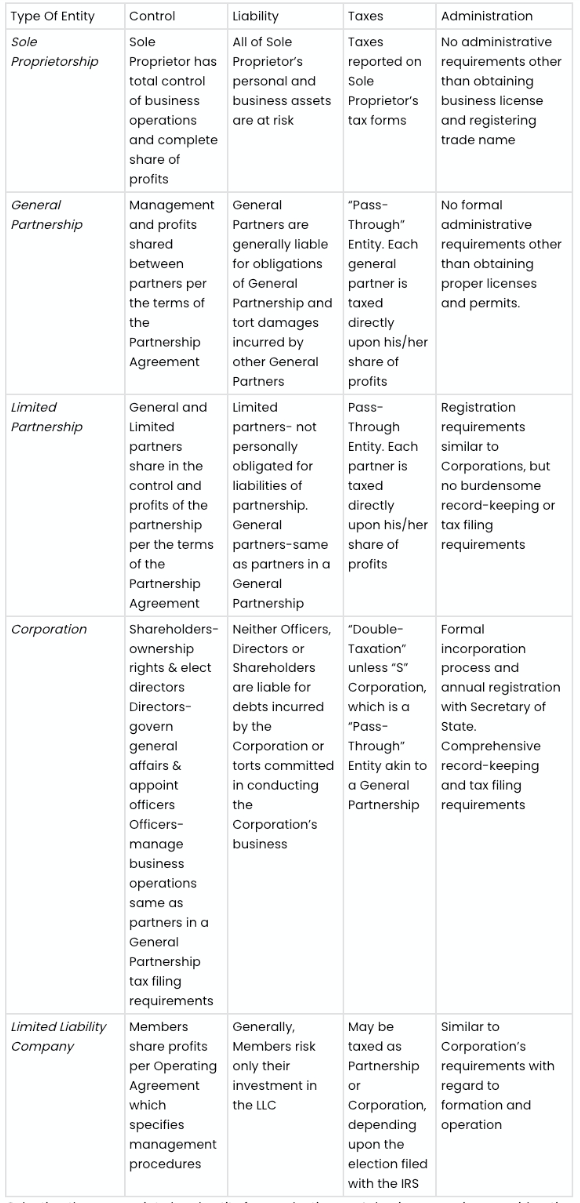

Summary: Should I Form an S-Corporation, a C-Corporation, a Close Corporation, or An LLC?

Small businesses should almost always be organized as a corporation or as an LLC. Many organize as a Sole Proprietorship (this is what you are if you do nothing) or as a Partnership (having two or more partners); but if times get tough, any creditors can sue you (and your partners, if a partnership) for any business debt, and go after your house, your car, your savings, and any other personal property of each partner. There is no way to protect personal assets from liability with a proprietorship or a partnership. Worse, in a partnership, they can come after your personal assets for any business debts incurred by your partner(s), no matter how outlandish.

With a corporation or an LLC, however, any debts against the company are only against the company, not your personal assets, unless you sign a “personal guarantee” for a loan. We will now list the different types of protected entities you can set up for your business, and how they differ.

LIMITED LIABILITY COMPANIES (LLC’S)

A Limited Liability Company (LLC) gives liability protection for all debts except your initial contribution (if any) to the LLC. It can have one, two, or many owners, as spelled out in its organizing document, the Operating Agreement. You must register it with the Secretary of State, and pay an annual registration fee. Unlike corporations, there are no detailed record-keeping requirements. Also unlike corporations, you do not have to list for public display who the officers are each year, so there is more anonymity from prying eyes; and you can buy and sell percentages of ownership interest and keep the records private. LLC’s can be taxed as either a flow-through (just added to your personal tax return), if there is only one owner, or as a partnership or as a corporation, depending on how you file with the IRS. There are

CORPORATIONS

A Corporation also gives liability protection for all debts except your initial contribution (if any). Like an LLC, it can have one, two, or many owners, as spelled out in its organizing document, the Articles of Incorporation. You must register it with the Secretary of State, and pay an annual registration fee. You must list for public display who the officers are each year, and you can buy and sell stock (percentages of ownership) of the corporation.

There are two different ways a corporation can be taxed:

S-CORPORATIONS

First, you can file an election with the IRS to be a Subchapter S Corporation, often referred to as an “S-Corp.” With this, you are taxed as a flow-through (just added to your personal tax return), if there is only one owner, or as if it were a flow-through partnership, if there are two or more owners.

C-CORPORATIONS

Second, you can be taxed as a regular corporation (sometimes called a “C-Corp”), which means the corporation files its own tax return. Most small business corporations do not like this, as it results in “double taxation”– taxes are first paid by the corporation on its return, then any money you received from the corporation in salary or distributions must be taxed on your personal tax return.

CLOSE CORPORATIONS

Corporations were originally set up for large companies (think General Foods, General Motors, GE, Wal-Mart, Delta, etc.) Corporations by law have many record-keeping and tax requirements; they were not originally intended for small mom-and-pop businesses.

Most small business corporations do not annually record who the officers are, do not hold an annual business meeting with reports given, do not record changes in policies and procedures in writing, etc., since they cannot afford a full-time Secretary, CPA’s, etc. to produce and maintain adequate required records. Therefore, when there is a lawsuit against a small corporation, often all the opposing attorney has to do is prove to the court these records are not up-to-date, and make a motion that the “corporate veil be pierced,” which means the corporation’s liability protection is wiped out, and the suing party can go after all the owner’s personal assets — house, cars, savings, etc.– as if no corporation existed (LLC’s generally do not have this problem). Fortunately, there is a way out of this common problem.

In Georgia, a corporation can be set up under Article 9, Chapter Two, Title 14 of the Georgia Code as a “Close Corporation,” also called a “Statutory Close Corporation” or a “Closely-Held Corporation.” (An existing standard corporation can also be converted to a Statutory Close Corporation.) This type of corporation does not have the record-keeping requirements of a normal corporation, and, depending on how the Articles of Incorpor-ation are written, can even do away with the Directors and Bylaws normally required by corporate status.

Like a standard corporation, a statutory close corporation must choose whether to be a C- Corporation or an S-Corporation with the IRS.

SUMMARY ADVICE TO SMALL BUSINESSES

Most small businesses find it most expedient to be either an LLC or a Subchapter S Close Corporation. However, situations can vary, and especially whether to be an S-Corp or C-Corp should be discussed with your CPA. We can set up any of these entities for you; call for a friendly free consultation.

Which Type of LLC Is Best for You?

If you have decided, after considering the various types of entities, that you want to have an LLC, the next decision you need to make is, what kind of LLC do you want to have, and how many owners will be involved? Georgia lawmakers have written the Limited Liability Company statutes in such a way that they are very flexible, and allow many options and variations as to organization and control. With certain exceptions, the Operating Agreement can be drafted to suit your particular needs and goals.

LLC’s may not issue publicly traded “stock” as a Corporation may; instead, an LLC issues Membership Units (or Interests), which are very similar, except that they may not be publically offered for sale; but these Units may be traded or sold between members, or assigned to new members, etc..

Ownership may be divided any way the organizing member(s) wish. For example, one person may well choose to be the sole member, with 100% ownership. Or two people (whether related or not) could each own half; or eight children or grandchildren could each own 5% while you retain 60%; or ten members could each hold 10%; or one member could hold 50% with two other members holding 25% each; or one member could hold 51% with all other members holding a total of 49%; etc..

Note that for tax purposes, the IRS does not regard a single-member LLC as an entity separate from its owner. Hence, if the sole member of an LLC is an individual, the LLC is treated as a sole proprietorship for tax purposes – i.e., it cannot be taxed separately from the owner; its income is taxed at individual rates, reported on a Schedule C attached to the owner’s 1040. If the sole member is a corporation or another LLC, then the LLC is treated as a division or branch of the owning corporation or LLC for tax purposes. However, if an LLC has two or more members, it may choose to be taxed either as a partnership (“flow-through,” each member reporting their respective share of income on their 1040) or as a corporation. Unless the LLC specifically elects to be taxed as a corporation, it will automatically be taxed by the IRS as if it were a sole proprietorship or a partnership. Which choice is best for your situation should be discussed with your CPA, who is familiar with your tax situation and goals.

One of the best advantages of LLC’s over Corporations is the privacy they afford. An LLC Operating Agreement is not a matter of public record, and is not on file anywhere except in the company records, which may be kept at your company’s office, your attorney’s office, or any other location chosen by the owner(s). Further-more, names of Managers, Members, and Officers, and percentages of ownership, ordinarily need not be reported to or kept on record by the government.

An LLC may be either Member-Managed or Manager-Managed. For most situations, we recommend that an LLC be Manager-Managed. See further down for descriptions of three common variations.

Three of the most common types of LLCs we set up are as follows:

A. MEMBER-MANAGED

(Members may have the same or differing percentages of ownership)

In this type of LLC, Members may have equal ownership and authority, or may have differing percentages of ownership and authority. But each Member is assumed for legal purposes to be a legal agent of the LLC, with legal authority to bind contracts, etc.. The Members may appoint one or more individuals to be Officers of the LLC. Officers need not be Members, and need not be residents of the State of Georgia.

B. MANAGER-MANAGED, TYPE I (Members choose one or more Members as Manager)

Under this organizational structure, there are one or more Members, but all functional authority is held by one or more Managers. This is a good choice when one or more people own a company, but wish for one of the Members (owners) to serve as Manager, whether salaried or unsalaried, to operate and control the business from day to day. It is also a good choice when the Members wish to have more than one Manager of equal authority to negotiate and close deals and bind contracts. Managers need not be residents of the State of Georgia, but must be Members of the Company.

C. MANAGER-MANAGED, TYPE II (All-powerful Manager until death, then replaced by vote)

Under this arrangement, there are one or more owners, but all authority is held by a single “all- powerful” manager who cannot be removed or replaced by the members regardless of their percentages of ownership. This sole Manager serves until death (or other event of dissociation, such as voluntary resignation, or incompetence), at which time the remaining Members must elect one or more successor Managers by majority vote. If the original sole Manager later wishes to share or turn over management responsibilities while he/she is still alive, he/she may also choose, by written consent, to allow one or more other Managers to be elected and serve at any time. Managers need not be residents of the State of Georgia but must be Members of the Company.

OTHER POSSIBILITIES

If none of these alternatives are exactly what you are looking for, contact us. We can draft a customized Operating Agreement for you to meet your particular needs.

IMPORTANT NOTE: Note that if an LLC is Member-Managed, then each Member is assumed for legal purposes to be a legal agent of the LLC, with legal authority to bind contracts, etc.. In addition, If an LLC is Manager-Managed but this fact is only cited in the Operating Agreement, and not mentioned in the Articles of Organization filed with the State, then each Member is still assumed for legal purposes to be a legal agent of the LLC, with legal authority to bind contracts, etc.. If the fact that the LLC is Manager-Managed is mentioned in the Articles of Organization, then only a designated Manager may be regarded for legal purposes to be a legal agent of the LLC, with legal authority to bind contracts, etc..

NOTICE: This information is of a general nature for informational purposes only, and may be altered or superseded by specific factors, circumstances, or conditions unique to your particular situation. Hence, it is not to be considered as or relied upon as legal advice. We recommend you obtain advice from both your C.P.A. and your attorney before making any decision.

Should My Failing Corporation or LLC File Bankruptcy if I Am Not Filing Personal Bankruptcy?

In this article, we are going to discuss each of the following areas:

I. Small Business Bankruptcy In General

II. Filing Chapter 7 Bankruptcy for Corporations and LLC’s

III. Reasons to File A Chapter 7 for Your Small Business Entity

IV. Reasons Not to File A Chapter 7 for Your Small Business Entity

V. Should You Consider Filing Chapter 11 Bankruptcy for Your Small Business Entity?

VI. Summary & Conclusion

Let’s get started:

I. Small Business Bankruptcy In General

Both a Corporation (S- or C-) and an LLC are legally treated as a “separate person” from yourself. Therefore, if the business has a lot of debt, and is not making enough to pay the debts down (or is losing money), you have no personal liability for any of the debts unless you signed a personal guarantee. However, the Feds will go after you personally for any unpaid payroll withholding taxes, and the State will go after you personally for any unpaid sales taxes.

Whether your small business entity should be bankrupted or not depends on several factors. Among the factors to be considered are:

- Do you have the time, energy, and desire to continue the business?

- Are there any significant assets (tools, inventory, vehicles, buildings, etc.)?

- What is the net worth of the entity, when debts are subtracted from assets? (You need an accurate current Balance Sheet to determine this.)

- How much profit or loss did your company generate during (1) the six calendar months prior to your bankruptcy filing and (2) for the year-to-date when you file?

- Do you own all the stock or membership interest? If not, who else does, and how much?

- Are any Federal withholding (payroll) taxes due? Are any State sales taxes due?

- Are there any unpaid salaries due?

Another matter to be decided in making this decision is, are your personal finances and those of your corporation or LLC (hereafter, called “entity”) entirely separate, or intermingled? Although they are supposed to be entirely separated, many (if not most) small businessmen intermingle them to some extent, sometimes hopelessly. For example, perhaps some months there isn’t enough money in your personal account to make a required house or car payment, so you write a check from your business account to cover it. Or, the business entity has some bills coming up, so you cover them by making payments using your personal charge cards. Intermingling like this can make it very difficult, or impossible, to figure who owes what. It can also invite a detailed tax audit of both yourself and the entity.

Whether intermingling is a problem or not, if your business entity is way behind on bills with no chance of catching up, it may or may not make sense to also file bankruptcy for the entity.

One thing that even some bankruptcy lawyers don’t know (in our experience) is that a corporation or LLC filing Chapter 7 bankruptcy is not permitted to discharge its debts in bankruptcy! Section 727(a)(1) of the Bankruptcy Code says, “The court shall grant the debtor a discharge, unless the debtor is not an individual.” Since corporations and LLC’s are separate persons, but are not individuals, they cannot receive a Chapter 7 discharge. After the entity’s bankruptcy is over, creditors can still go after its assets, if any remain.

Note: In making the decision whether or not to file bankruptcy for your small business Corporation or LLC, you must provide the company’s bankruptcy attorney with accurate valuations, including detailed income and expenditure records, profit and loss statements, inventory records, etc.. Even your accountant may not have all this information. A bankruptcy trustee will ask you how you valued your company, and you need to have clear, concise explanations as to how you determined the value of each item to avoid harming your case.

Corporations or LLC’s can file either Chapter 7 bankruptcy or Chapter 11 bankruptcy, but not Chapter 13 bankruptcy. Although they cannot discharge their debts in a Chapter 7, they can under certain circumstances in a Chapter 11. We will say more about Chapter 11 later. For the present, suffice it to say that very few small corporations or LLC’s are good candidates for a Chapter 11.

II. Filing Chapter 7 Bankruptcy for Corporations and LLC’s

Chapter 7 is for the liquidation of a failed entity, not for reorganization or continued operation, as in Chapter 11. Many times, when the owner of a small business corporation or LLC concludes that their entity is losing money and there are no assets in the entity, they just stop operating it, and do not bother to file bankruptcy for the corporation, to save money. (They allow the corporate status to lapse with the State by not renewing the annual registration; eventually, usually two years or so after the entity stops paying annual registration fees, the State terminates the existence of the entity by Administrative Dissolution.)

If there are no assets, in many cases this makes sense, as entity debts not personally guaranteed by the owner cannot be charged to him/her. However, if the owner has personally guaranteed the entity’s loans or lines of credit, the owner can be sued for any default. In this case, if the debts are significant, the owner may wish to file personal bankruptcy, whether or not they file bankruptcy for the entity.

There are several situations in which it makes good sense to file a Chapter 7 for the entity, even though no discharge is available. Let us now consider these.

III. Reasons to File A Chapter 7 for Your Small Business Entity

1. If your entity has any assets and owes employment (payroll withholding) taxes or sales taxes, you do not want regular business creditors to get the assets first by filing collection suits. If they do, the Federal government will later go after you personally for unpaid payroll taxes, and the State will go after you personally for unpaid sales taxes. By filing bankruptcy for the entity, the Trustee will pay these more important claims first, in order of priority under the Bankruptcy Code, before paying any remaining assets to less important creditors. Also, the Trustee will give priority treatment to any unpaid wages which were earned by any employees of the entity (possibly including you) during the 180 days before filing bankruptcy (or cessation of the business, whichever came first), up to $10,000 per employee.

2. If there are considerable assets (such as product inventory, vehicles, tools, one or more buildings, etc.), but the business is not going to continue, the owner may wish to hand off the duties of liquidation and distribution of assets to a bankruptcy trustee. This way there is no question that the creditors have been fairly treated under the bankruptcy code, and that they have received all that is available for distribution, even if it is only pennies on the dollar.

3. Sometimes if the corporation or LLC defaults on its debt and does not declare bankruptcy, one or more of the creditors may file suit in hopes of collecting the debt, often naming the owner/shareholders as well in the suit. Even if only the entity is named, and the owner ignores the suit, when the court enters a default judgment, the creditor(s) may well require post-judgment interrogatories to determine whether there are any assets to attach. If the owner or former president/director/manager does not produce these, they could be fined or jailed for contempt of court.

Additionally, the State of Georgia no longer allows an officer or owner of an entity to answer for it in court, but requires a licensed attorney to do so. Paying an attorney to do this, and/or paying an attorney to answer for you if they also sue you personally, often costs more than simply filing a Chapter 7 bankruptcy for your entity. Besides, by filing a Chapter 7 for your entity, you make a claim that there are no assets to distribute more credible, and a matter of public record.

However, filing a Chapter 7 for your corporation or LLC can conceivably cause unnecessary problems for an owner/ shareholder /membership interest holder. Here are three of them:

IV. Reasons Not to File A Chapter 7 for Your Small Business Entity

1. The bankruptcy Trustee is obligated by his position to try to find a way to pay creditors. Besides liquidating any assets of the corporation, he may look for other sources of cash. If the entity’s financial affairs were intermingled with those of the owner(s)/shareholder(s)/membership interest holder(s), as described above, the Trustee may choose to seek to reimburse creditors by suing the owner(s)/ shareholder(s)/membership interest holder(s) and piercing the corporate veil.

2. If the small business entity was undercapitalized, as is the case with most small business entities, there is a risk that the Trustee would seek to hold the owner(s)/shareholder(s)/membership interest holder(s) liable for all the debts of the corporation.

3. The Trustee could also sue to collect loans made by the small business entity to the owner(s)/shareholder(s)/membership interest holder(s), and he could also sue to recover loan payments made to them in repayment for loans they made to the entity in the year or more prior to bankruptcy. Before deciding whether to file a bankruptcy for your corporation or LLC, you should consider all these factors with a good bankruptcy attorney.

V. Should You Consider Filing Chapter 11 Bankruptcy for Your Small Business Entity?

Chapter 11 bankruptcy is sometimes considered as a possible solution by owners of small corporations or LLC’s. Chapter 11 is primarily meant for reorganizing the financial affairs of large and small corporations, partnerships, and LLC’s, to enable the business to continue to operate and hopefully become profitable when it finds that its debts are more than its income. If the business could prosper if only it wasn’t servicing old, non-recurring debt, or if could prosper if it could shed non- critical equipment or premises leases, Chapter 11 may be the answer.

However, Chapter 11 is much more complicated and expensive than Chapter 7 or Chapter 13. Just the filing fee alone to start a new Chapter 11 proceeding is $1,213.00; and a typical cost for legal fees might easily be $10,000 or $20,000 the first year alone. The time period is variable; it could easily be longer than five years, if necessary. There are a lot of reports required for taxes, insurance, operations, and bank accounts. But with Chapter 11 you can get out of any leases for offices or equipment you do not really need, and you can force secured creditors (such as mortgage holders of an office building or factory you are buying, or loans with which you bought vehicles your business needs) to re-write the loans down to the actual cash value of the items being paid for, possibly with other improvements in the terms.

The problem with small business Chapter 11 cases is that they fail very often (that is, they are dismissed by the Court, or forcibly converted to a Chapter 7 by the Court). In fact, it is the opinion of many good bankruptcy attorneys that most small-business Chapter 11 cases fail. The corporation or LLC may not be able to keep the company running without further losses, or may be unable to keep up with the reporting requirements and expenses of the Chapter 11, and consequently fail. The key to avoiding failure is limiting Chapter 11 filings to cases where a Chapter 11 is really called for and could work, combined with careful planning before filing. Even when Chapter 11 is appropriate, cases most likely to fail are the ones filed on an emergency basis, with inadequate accounting or planning as to the company’s true prospects for success.

The main purpose of Chapter 11 is to allow time to reorganize the business to make it successful (or, in the alternative, to allow for orderly, fair liquidation). If the business is not making money now, why not? Is there any evidence or reason this is likely to change? Will layoffs or trimming excess expenses enable the core business to succeed? Was the difficulty due to embezzlement or mismanagement by an employee or manager who is now gone from the company? If filing Chapter 11 will allow time and means to make the business profitable in the future, and stop losing money, and if the small business can meet all the other expenses and requirements, then the Chapter 11 might succeed. Filing just to stall creditors may only delay inevitable business failure. Small businesses should not rush into a Chapter 11 on an emergency basis, without careful planning; that may only be a waste of time and a lot of money. First make sure you have accurate, complete accounting, and up-to-date tax returns, so you and your CPA and a good bankruptcy lawyer can determine the true position of your company and the advisability of filing Chapter 11.

WARNING: occasionally certain law firms like to steer their clients towards Chapter 11 when a much cheaper Chapter 7 would have been much more logical, because under Chapter 11, the law firm stands to make tremendously higher fees, perhaps from four to thirty times as much! For a small company, just the legal fees alone can contribute to failure in a Chapter 11. Such firms sometimes advise their clients to file under Chapter 11 knowing that it is unlikely to succeed, and that the case will likely be dismissed or converted to a Chapter 7 by the court, after the law firm has made a lot of money from the client.

Fortunately, most reputable law firms would not do such a thing, but sometimes, this word to the wise may save you a lot of unnecessary expense and trouble. And a law firm is likely giving you good advice to file Chapter 11 if it is a case where Chapter 11 is the only way possible to keep a business going which has a good chance of success. Situations vary; be sure to see a qualified attorney for advice in your particular case.

VI. Summary & Conclusion

Depending on the circumstances, it may or may not make sense to file bankruptcy for a failing small business. If there are significant assets and/or significant unpaid employment or sales taxes, it is much more likely to be a good idea. However, every case is different, and you need to gather the information listed above and sit down with a good bankruptcy lawyer with significant small business experience to discuss your particular situation. Call us for a free consultation.

More detail: Which Is Best for Your Business – A Proprietorship, A Partnership, A Corporation, or An Limited Liability Company?

Following is more information on each of the five entities outlined briefly in the above chart.

Corporations

A corporation is a legal entity that is separate from its owners, the shareholders. It is formed by filing certain documents with the Secretary of State and taking other actions required by the Code. A corporation may have perpetual existence, meaning that it continues to exist regardless of the status of the individual shareholders.

CONTROL A corporation is composed of three different “players”: the shareholders, directors and officers. It is critical to understand that these players have different responsibilities, obligations and authorities. The shareholders own the corporation and elect the directors. The directors govern the general affairs of the corporation and appoint officers who conduct the day to day business of the corporation. It is typical in smaller corporations for an individual to hold two or three “player” positions. In fact, one person can be the sole shareholder, director and officer.

LIABILITY Limited liability is the most important reason to incorporate. The debts incurred by the corporation cannot generally be collected from the officers, directors or shareholders of the corporation. This allows one to protect his or her personal assets from the debts and obligations of the corporation. However, oftentimes shareholders are called upon to guaranty payment of the debts of the corporation. It is important to keep personal and business dealings separate from the corporation’s business in order to ensure that one cannot be personally liable for obligations of the corporation.

May be taxed as Partnership or Corporation, depending upon the election filed with the IRS

Similar to Corporation’s requirements with regard to formation and operation

TAXATION “For profit” corporations (other than S corporations, which are discussed below) are subject to what is know as “double taxation.” This means that the corporation pays tax on the income earned by the corporation and its shareholders pay tax on dividends received from the corporation. An S corporation is not subject to double taxation. Rather, for tax purposes, it is known as a “pass- through” entity (as is a partnership). The term “pass-through” means that there is no tax on the corporation, but that the income and losses of the S corporation are passed through to the shareholders in proportion to their ownership interests whether or not they record a distribution. A corporation can be an S corporation merely by meeting certain eligibility requirements and making a special election with the IRS. These eligibility requirements include having no more than 75 shareholders who must be individuals or certain trusts or estates. Further, the shareholders may not be non-resident aliens and the S corporation can only have one class of stock. From a legal standpoint, an S corporation is no different than any other corporation. It is organized and operated like other corporations and has all of the characteristics of a corporation described above. From a tax perspective, however, they are very different. A tax professional should be consulted to determine whether the shareholders will benefit from causing a corporation to make an S election.

ADMINISTRATION The corporate form of doing business does have some disadvantages. Sine the corporation is a separate entity, it must file tax returns and pay taxes on its income. A corporation must maintain certain records in order to ensure that its corporate status is maintained. This means additional accounting and legal costs associated with using the corporate form of doing business.

Limited Liability Companies (LLC’s)

The Limited Liability Company (LLC) is a business entity organized under state law that offers limited liability like a corporation along with the possibility of “passthrough” taxation, unless it elects corporate treatment for federal tax purposes. Therefore, an LLC is a cross between a partnership and a corporation. An LLC is owned by one or more interest holders called “members” and any member can exercise management rights. However, an LLC also allows the members to manage the entity or to designate specific managers who may or may not be members, to manage the entity as is done in many corporations. Like a corporation, an LLC has the advantage of “perpetual” existence — its business operations can continue despite the death of someone who owns a business interest. Ownership interests are transferred easily from one member to another.

LIABILITY As its name implies, the LLC provides limited liability for its owners similar to shareholders in a corporation. The LLC owner risks only their investment in the business. Other personal assets are not a risk, unless the owner has personally guaranteed the debt.

TAXATION Under new IRS regulations, the LLC with more than one member will be taxed as a partnership unless it elects to be taxed as a corporation and the LLC with only one member will be disregarded for tax purposes. If it is treated as a partnership, the LLC’s earnings will be apportioned to its owners and taxed at their personal tax rates, similar to the tax treatment of a limited partnership. However, it is possible to elect corporate tax treatment, whereby it will be taxed as a corporation.

ADMINISTRATION The process of creating an LLC closely resembles the process of creating a corporation. Georgia law requires that “Articles of Organization” be filed with the Secretary of State. An LLC has an “operating agreement” which, like the agreement of partnership or LP, determines the conduct of the business, including the rights and powers of its members, managers, and employees and which generally allows the members to structure the company’s affairs as they see fit, rather than as a statute requires.

Sole Proprietorship

The sole proprietorship is the simplest, least regulated and most common form of business organization. Legally and for tax purposes the individual owner is the business. The liabilities and profits are personal to the owner.

CONTROL The sole proprietor has total control of the business. The problem with total control is that if the owner dies, the business ceases to exist. The assets and liabilities of the sole proprietor will pass to his or her estate, but often the expertise and knowledge of the business usually die with the sole proprietor. A competent estate planning lawyer can assist the sole proprietor in arranging for the business to be transferred to a family member or some other person upon the death of the sole proprietor.

LIABILITY In a sole proprietorship, all of the personal and business assets of the sole proprietor are at risk. One obtaining a legal judgment for damages against a sole proprietor can secure a lien against his or her personal assets and can foreclose on the lien. This unlimited liability is the greatest disadvantage of this type of business form. Different types of insurance coverage are available to lessen the perils of having one’s personal assets at risk.

TAXATION Taxes are reported on the sole proprietor’s personal income tax forms. The sole proprietorship is the simplest form of business for tax purposes. As the business grows, the sole proprietor may wish to change to another business organization if it would result in significantly lower taxes. Sole proprietors should also contact their local, state and federal tax authorities regarding the collection of sales and other taxes.

ADMINISTRATION The sole proprietor should maintain adequate records to successfully run the business and for tax purposes. However, there are no administrative requirements, such as maintaining minutes of meetings or passing resolutions, with which he or she must comply. Usually, the only requirement is to obtain and pay the fee for a local business license. Georgia also requires that a sole proprietor operating under a trade name register in the county where it will transact a majority of its business. This allows creditors and others the opportunity to learn the identity of the actual owner, since it will be the owner who is personally liable for the debts and obligations of the business.

General Partnership

The legal form of doing business as a general partnership comes into existence when there is an association of two or more persons, the general partners, who carry on a business for profit as co- owners. The existence of a profit motive is essential. No filing or other registration with the Secretary of State is required.

CONTROL Each general partner has a right to participate in partnership management, as well as a right to share in the profits of the partnership. The issue of control can be addressed with a partnership agreement. This written agreement is not legally required, but it encourages specificity. An interest in a general partnership cannot be transferred without the consent of the other general partners (unless the transferred interest is only a right to profits). Death or withdrawal of any general partner dissolves the general partnership.

LIABILITY Each general partner has joint and several unlimited personal liability for obligations of the general partnership. This means that each general partner has the potential of being personally indebted for each obligation of the general partnership. One general partner’s actions can make another general partner personally liable on a contract. Similarly, the actions or torts of one general partner arising in the ordinary course of the general partnership’s business can result in another general partner being personally liable on a contract or in a lawsuit. Further, a general partner owes the utmost duty to the general partnership and to each of the other general partners. In order to limit the liability of a general partner, such entities often elect to be treated as a LLP by filing a certificate with the Secretary of State.

TAXATION Partnerships are “pass-through” entities for tax purposes; the general partnership itself does not pay taxes. Each general partner takes into account his or her share of general partnership income, losses, deductions and credits in determining his or her personal tax liability. A partnership agreement may provide for the allocation of these tax benefits and burdens.

ADMINISTRATION General partnerships do not require any formal organizational meeting or state filing requirement to come into existence. The only obligations required are those germane to all business entities such as a business license, trade name registration, proper permits and the like, unless a decision is made to elect LLP status.

Limited Partnerships (LP’s)

A limited partnership is composed of general partners and limited partners. The defining characteristic of a limited partnership is that limited partners can invest capital in a business of the limited partnership and take a share in the profits without becoming personally liable for partnership debts and obligations.

CONTROL Unlike limited partnerships in many other states, in Georgia limited partners may participate in controlling the business without becoming personally liable for the limited partnership’s obligations. Thus, Georgia is a particularly attractive state for the formation of limited partnerships in which limited partners wish to have an active role in the management and control of limited partnership affairs. The limited partnership agreement may govern which partners or classes of partners control the entity. As with general partnerships, Georgia law will govern the handling of matters not addressed in the partnership agreement. General partners have equal rights to participate in the management of the limited partnership and have the power to bind the limited partnership in transactions with third parties. A limited partner can assign his or her interest in the profits of the limited partnership and the assignee may become a limited partner if the limited partnership agreement so provides or if all other partners consent.

LIABILITY As mentioned above, limited partners are not personally obligated for the liabilities of the limited partnership by reason of being a limited partner and do not become so by participating in the management or control of the business. A general partner has unlimited liability, similar to a general partner in a general partnership (except as otherwise provided in the Georgia Revised Uniform Limited Partnership Act). To avoid such unlimited liability, many limited partnerships have a corporation as their general partner. Alternatively, the entity may limit the liability of the general partner by electing LLP status through a filing with the Secretary of State. Each general partner owes the utmost duty to the limited partnership and to each of the other general and limited partners.

TAXATION The limited partnership pays no entity-level income tax or net worth tax, and each partner is taxed directly upon his or her respective distributive share of the limited partnership’s profits (which may or may not be the same as their ownership percentage), unless the limited partnership elects to be taxable as a corporation.

ADMINISTRATION Limited partnerships in Georgia are required to register with the Secretary of State, but are governed by a Limited Partnership Agreement among the parties, and generally do not have to contend with burdensome requirements for filings, publications, or record maintenance.

Tax Considerations for Different Types of Business Entities

I. TYPES OF BUSINESS ENTITIES

A. “S” CORPORATION BASICS

1. Single Level of Tax

a. Shareholders are taxed on their pro rata share (% of) ownership; losses are allocated the same way, by shareholdings.

Subsequent distributions to the shareholders are not again subject to income tax.

b. Exceptions to the single-level of tax – these exceptions apply only if the “S” Corporation was previously a “C” corporation:

i. 10-year built-in gains tax on the appreciation in any assets at the time of the “S” election – this corporate level tax only applies upon taxable sales of the assets during the first 10 years as an “S” corporation.

ii.“S” corporations with excessive interest, dividend and other passive income that also have “C” corporation earnings and profits can be subject to a corporate level tax and possible termination of “S” corporation status.

2. Single Class of Stock Requirement

a. All stock must have the same distribution rights.

b. No liquidation preferences are permitted.

c. Differences in voting rights are permitted – voting and non voting stock are permitted.

3. Limit on Number and Type of Shareholders

a. No more than 35 shareholders.

b. The only permitted shareholders are individuals, estates, certain trusts, employee benefit plans (ESOPs) and 501(c)(3) organizations.

c. Ineligible shareholders include partnerships, corporations, LLCs and non- US resident aliens.

4. Formation

a. Articles of Incorporation filed with the Secretary of State.

b. Other documentation required/desirable are (i) Bylaws, (ii) Subscription Agreements, (iii) Stock Certificates, (iv) Shareholders Agreements and (v) Board of Director minutes.

c. IMPORTANT: An “S” election (IRS Form 2553) must be filed with the IRS within 75 days of the start of the tax year. DON’T MISS THIS DEADLINE.

5. If the “S” corporation owns 100% of the stock of another corporation, the subsidiary may elect to be treated as a “Qualified Subchapter ‘S’ Subsidiary” or “QSSS.” A QSSS is ignored for federal and (in most states) state income tax purposes and, instead, treated as a division of the “S” corporation. An election to be a QSSS must be filed with the IRS, and care must be taken in making the election to avoid unexpected income tax consequences.

6. Warning: A judgment against an “S” corporation can sometimes be collected by seizing the personal assets of the corporate officers through a legal procedure known as “piercing the corporate veil.” This can be done by the opponent showing the court, if possible, that the officers of the corporation are not properly carrying out correct corporate procedures (keeping minutes of meetings, following all bylaws, keeping proper corporate records, correctly holding annual corporate meetings and elections of officers, etc..) This situation can usually be avoided by incorporating as a “close” or “closely held” corporation, or setting up an LLC instead.

B. “C” CORPORATION BASICS

1. Two levels of tax: corporation pays taxes on its income, and (a) shareholders pay tax on dividends and other distributions received from the corporation, (b) any salaried workers pay both income and SS taxes.

2. Consolidated returns are available for 80%-owned subsidiaries.

3. Formation – the same as for “S” corporations, except an “S” election is not filed.

5. WARNING: A judgment against a “C” corporation can sometimes be collected by seizing the personal assets of the corporate officers through a legal procedure known as “piercing the corporate veil.” This can be done by the opponent showing the court, if possible, that the officers of the corporation are not properly carrying out correct corporate procedures (keeping minutes of meetings, following all bylaws, keeping proper corporate records, correctly holding annual corporate meetings and elections of officers, etc..) This situation can usually be avoided by incorporating as a “close” or “closely held” corporation.

C. PARTNERSHIP BASICS

1. Entities treated as a partnership for income tax purposes include:

a. Limited Liability Company (“LLC”) with more than one member – limited liability for all members.

b. General Partnership/Joint Venture (“GP”) – unlimited liability for all partners. Also, you are100% legally bound by any contracts, agreements, or indebtedness which any of your partners may agree to, with or without your agreement, approval, or knowledge.

c. Limited Partnership (“LP”) – unlimited liability for the general partner(s) but limited liability for the limited partner(s).

d. Limited Liability Partnership (“LLP”) – a form of GP that provides some liability protection to the general partners.

e. Limited Liability Limited Partnership (“LLLP”) – a form of LP that provides some liability protection to the general partners.2. A single level of tax – partners (or members, in the case of LLCs) are taxed on their allocable share of the entity’s income.

2. Federal taxation of multiple-member LLCs – If an LLC has two or more members, it may choose to be taxed either as a partnership (“flow-through,” each member reporting their respective share of income on their 1040) or as a corporation. Unless the LLC specifically elects to be taxed as a corporation, it will automatically be taxed by the IRS as if it were a partnership. Which choice is best for your situation should be discussed with your CPA, who is familiar with your tax situation and goals.

3. State taxation of multiple-member LLCs – Only Texas taxes LLCs as a corporation. All other states either always tax LLCs as a partnership, or follow the federal “check the box” regulations.

4. Formation

a. LLCs, LP, and LLPs require filings with the Secretary of State, while GPs require no filing to be created.

b. An operating (for LLCs) or partnership agreement is needed to set forth the agreement among the owners concerning management, distributions, allocations, transferability of interests, and other matters concerning the entity.

D. SINGLE-MEMBER LLC BASICS

1. For federal income tax purposes, the single member is treated as engaging directly in the activities of the LLC and reports all income/loss on the member’s tax return.

2. For tax purposes, the IRS does not regard a single-member LLC as an entity separate from its owner. Hence, if the sole member of an LLC is an individual, the LLC is treated as a sole proprietorship for tax purposes- i.e., it cannot be taxed separately from the owner; its income is taxed at individual rates, reported on a Schedule “C” attached to the owner’s 1040. If the sole member is a corporation or another LLC, then the LLC is treated as a division or branch of the owning corporation or LLC for tax purposes.

3. Nearly every state follows the federal income tax treatment of single member LLCs for state income taxes.

4. Formation

a. LLCs require filing with the Secretary of State.

b. An operating agreement is needed to spell out management, distributions, allocations, transferability of interests, and other matters concerning the entity.

II. INHERITANCE TAX CONSIDERATIONS

“S” or “C” corporation stocks, or LLC membership interests, are only subject to inheritance tax when the person owning them passes away; none of the stock or interests held by other owners are subject to inheritance tax as a result of the other owners’ death. For example, a parent could form an LLC with three children, and arrange for each of them to have a 30% ownership interest, retaining 10% and full control under an “All-Powerful Manager for Life” operating agreement. Even if the LLC is worth many millions, the 90% of that value owned by the sons would be totally free from estate tax upon the death of the parent. The same could be done with stock ownership in an “S” or “C” corporation.

III. COMPARISON OF ENTITY CHOICES

A. CORPORATION (“S” OR “C”) VS. PARTNERSHIP

1. Contributions of Appreciated Property

a. To avoid gain recognition on a contribution of appreciated property to a corporation, the contributing shareholders must own 80% or more of the corporation. No such rule applies to a partnership – a contributing partner could own 5% (or less) of the partnership and still avoid gain recognition.

b. Pursuant to IRC §704(c), however, a partner contributing appreciated property ultimately pays tax on 100% of the appreciation (either over time or when the property is sold by the partnership). With an “S” corporation, the burden of appreciation is shared by the shareholders pro rata when the property is sold. With a “C” corporation, the corporation pays the tax when the property is sold.

2. Exit Strategies – Distribution of Appreciated Property and Tax-Free Reorganizations

a. Subject to certain limitations, partnerships can distribute appreciated property to partners tax free, while a distribution of such property by a corporation (“S” or “C”) is a taxable event.

b. Corporations (“S” or “C”) can participate in tax free reorganizations, with their shareholders receiving stock of another corporation (e.g. a public company) as nontaxable consideration – not so for a partnership.

3. Equity Ownership by Employees

a. The special tax rules governing incentive stock options, employee stock purchase plans and ESOPs only apply to corporations.

b. The exercise of an option to acquire an interest in a partnership is always a taxable event to the optionee and can result in complicated tax considerations for the partnership and the other partners.

c. Special equity interests in a partnership which only share in any future increases in the value of the partnership can be crafted and avoid current income recognition by the employee receiving such an interest – these interests are called “profits interests.”

B. PASSTHROUGH ENTITY (“S” CORPORATION, PARTNERSHIP, OR TWO OR MORE MEMBER LLC) VS. “C” CORPORATION

1. Two levels of tax vs. one level of tax (people with passthrough entities pay taxes once; with a “C” Corporation, you pay taxes at the corporate level, then pay taxes on your individual 1040.)

2. What if all income will be reinvested in the business?

a. If the owners are individuals, the income of the flow through entity is taxed at the individuals’ tax rates of up to 39.5%.

b. The highest rate for a “C” corporation, however, is 34% (for income up to $10,000,000). This 5.5% differential is $55,000 per million dollars of income – this savings could be significant, particularly if the “exit strategy” involves an IPO, a stock sale or a reorganization (where the “single level” of tax for a flow through entity is not a benefit) and not an asset sale.

3. Losses flow through to the owners of a passthrough entity – but can the owners use them? (The passive loss and at risk rules, as well as certain “basis” requirements, limit the owner’s ability to currently use passthrough losses to offset other income.)

4. Certain employee benefits, such as cafeteria plans, can only be provided on a tax-favorable basis to employee-shareholders of a “C” corporation – they cannot be provided to partners or employee- shareholders of an “S” corporation.

C. PARTNERSHIP VS. “S” CORPORATION

1. Flexibility (in owners and ownership interests)

a. Anyone can own an interest in a partnership without jeopardizing the flowthrough tax treatment.

b. Partnerships can have complicated/flexible economic sharing arrangements.

2. Basis for Debt –

a. Basis is important for both partnerships and “S” corporations:

i. losses can only be used to the extent of the owner’s tax basis in the ownership interest.

ii. distributions are not taxable to the extent they do not exceed the owner’s tax basis in the ownership interest.

b. A partner can include debt of the partnership in basis – a shareholder of an “S” corporation cannot – another reason why real estate investments should rarely be done through an “S” corporation.

3. Purchase of Interests

a. Through a Section 754 election, the purchaser of a partnership interest can increase his/her allocable share of depreciation/amortization deductions for partnership property which has increased in value.

b. No such “step-up” in depreciation is available to the purchaser of stock of an “S” corporation.

4. Self Employment Taxes.

a. If a partner is actively involved in managing the business of a partnership, and the partnership generates income subject to the self-employment tax (that is, income other than rents, royalties, dividends or interest) the partner’s allocable share of all such income is subject to self-employment taxes.

b. A shareholder’s share of the income of an “S” corporation is not subject to self- employment taxes. If the shareholder works in the business, however, a “reasonable” salary (subject to all employment taxes) should be paid or the IRS will impute one. But any “S” corporation earnings in excess of such a “reasonable salary” will avoid any employment taxes.

D. “S” CORPORATION VS. “C” CORPORATION

1. IRC § 1202 permits the exclusion of 50% of the gain from the sale of “qualified small business stock” (or “QSBS”) held for more than five years, and IRC § 1045 permits a rollover of gain from the sale of QSBS held for at least 6 months to the extent the proceeds are reinvested in other QSBS within 60 days of the sale.

2. QSBS is stock of a “C” corporation which is acquired from the corporation if:

a. the corporation is engaged in an “active business”

b. the corporation’s aggregate gross assets (by tax basis) did not exceed $50 million at the time the stock was issued or any time after August 10, 1993; and

c. numerous technical requirements are satisfied.

E. PARTNERSHIP (GP OR LLC) VS. “C” CORPORATION

1. A partnership cannot be publicly traded

2. Foreign owners:

a. Sale of stock of a “C” corporation by a non-resident US person is not subject to any US income tax

(absent FIRPTA for real estate companies).

b. A partner can be deemed to be engaged in the partnership’s business and must file and pay US income

taxes – foreigners generally seek to avoid being engaged in a US trade or business.

3. An LLC (which is treated as a partnership for tax purposes by the IRS unless the LLC elects otherwise) is simpler to operate and file tax returns for than a “C” corporation.

F. SINGLE MEMBER LLC VS. “S” CORPORATION

1. All income of the LLC is subject to self-employment taxes where the business generates income subject to self-employment taxes and the owner is actively involved.

2. Income of an “S” corporation is not subject to self-employment taxes – as discussed above, however, a reasonable salary (subject to employment taxes) should be paid to a shareholder who works in the business.

3. A single member LLC is simpler to operate and file tax returns for than an “S” Corporation.

4. A single member LLC may not elect to be taxed as a corporation, as an LLC with two or more

members may; the IRS requires that a single-member LLC be taxed as a sole proprietorship, usually on a Schedule “C” attached to the owner’s 1040.

NOTICE: This information is of a general nature for informational purposes only, and may be altered or superseded by specific factors, circumstances, or conditions unique to your particular situation. Hence, it is not to be considered as or relied upon as legal advice. Also, tax laws, policies, and interpretations change frequently, hence the information may not be up to date, despite our best efforts. We recommend you obtain advice from both your C.P.A. and your attorney before making any final decision based on any information herein.

Important documents you should have

You never know when you might have an unexpected severe auto accident, a sudden stroke, a heart attack, etc..

It is unkind to leave your loved ones with a legal and financial mess because you did not provide adequate documents “just in case.”

1. A GEORGIA FINANCIAL POWER OF ATTORNEY FOR FINANCIAL AFFAIRS. This enables the person of your choice to pay your bills and legally handle your financial and business affairs if you were to be in a coma, in a serious accident, too ill to take care of things for yourself, etc..

2. A “LIVING WILL” - A GEORGIA ADVANCE DIRECTIVE FOR HEALTHCARE with ANATOMICAL GIFT INSTRUCTIONS. This enables the person of your choice to make important medical decisions on your behalf, or carry out your instructions, if you are in a coma or unable to speak. Would you ever want them to discontinue life support machines? Discontinue intravenous food and water, or pain medication? At what point? This document also allows you to make your wishes clear as to whether you intend to donate any body parts for transplants to help the living after you pass away, and as to whether you wish to allow or require an autopsy after your decease. Settle these matters the way you want, now, while you are able to.

3. A LAST WISHES AND FUNERAL INSTRUCTIONS form. This is separate from your Will, because it includes much information your survivors will need immediately after your death, such as: Would you prefer burial or cremation? Where? What kind of headstone or urn? What kind of funeral service, if any? Performed by whom? What kind of music, or church, or minister? Your survivors cannot honor your last wishes if they are not sure what they are. This fill-in-the-blanks form enables you to think through these and many other similar questions, and then leave this information for your survivors’ guidance.

4. An INFORMATION FOR MY EXECUTOR AND HEIRS form. Where would your survivors find your insurance policies? Your safe deposit box key? Do they know where all your property, stocks, bonds, and checking and savings accounts are located? This fill-in-the-blank form ensures that such information is available after your decease.

What Will All of This Cost?

Single Person- $200

Married Couple (two complete sets of documents)- $300

Although we do not usually produce wills, you should also have a LAST WILL AND TESTAMENT, designed specifically for your particular personal and family situation. In certain cases, you could avoid needing a Will, for example by holding real estate as JT-ROS (Joint Tenancy with Right of Survivorship) and holding bank accounts as POD (Payable On Death).